Schedule a No Obligation consultation and get a free gift

Take a positive step

Protect What Matters Most with Life Insurance and Annuities

When it comes to your financial future, planning ahead is the most important step you can take. Our life insurance and annuity solutions are designed to help you provide for your loved ones, protect your assets, and create a steady income stream for the years to come.

Take a positive step

Protect What Matters Most

When it comes to your financial future, planning ahead is the most important step you can take. Our life insurance and annuity solutions are designed to help you provide for your loved ones, protect your assets, and create a steady income stream for the years to come.

Meet Jerry Brown - Your Trusted Financial Expert

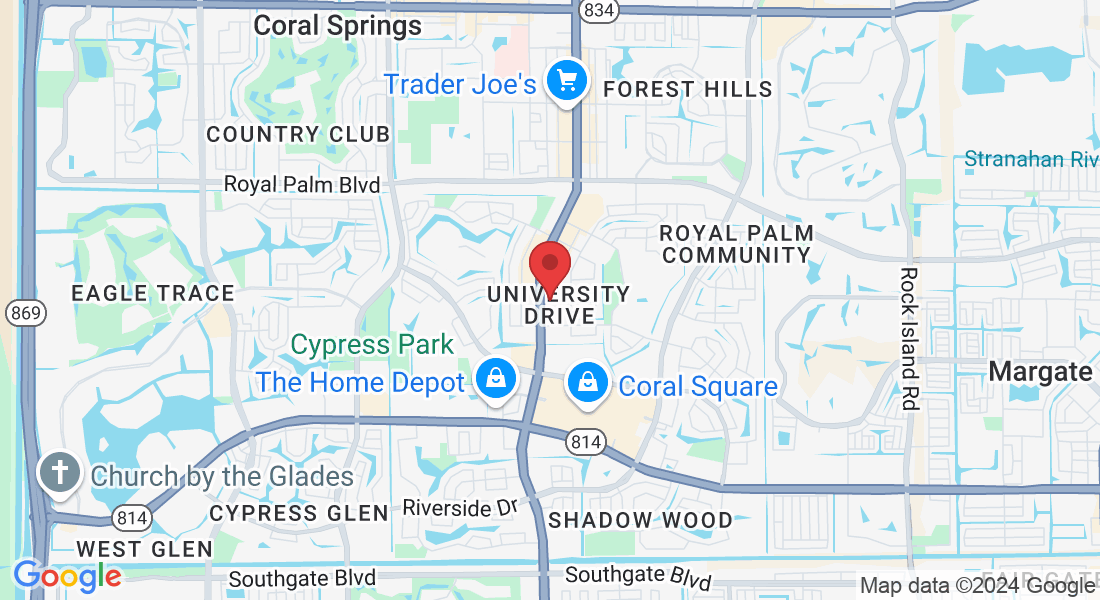

Jerry Brown is a Senior Partner at Pinnacle Financial Group, in Coral Springs Florida

I am Married and have 4 Children and 7 Grand Children

Started in the Financial Industry since 2008 as an Advisor and Agent.

My Licenses and Certifications:

Series 6 Securities License, Life and Health Agent.

Former Registered Representative with Transamerica Financial Advisors

Florida State License Number: P222905, NPN-15536744.

Master of Public Administration & Bachelor of Science Degrees

Retired Police Sergeant & Graduate of the FBI National Academy S-210

Certified Public Pension Trustee (CPPT)

Financial Coach & Trainer

Loves to Help People Win!

Financial Solutions I Assist Clients With

Annuities

Fixed Annuities, Fixed Index Annuities, Income Annuities, Annuity Living Benefits

IRAs

Rollover IRAs, Traditional IRAs, Roth IRAs, IRAs for Spouses, SEP IRAs, SIMPLE IRAs

Life Insurance

Term Life Insurance, Universal Life Insurance, Indexed Universal Life Insurance, Variable Universal Life Insurance, Survivorship Life

Workplace Retirement Plans

401k Plans, 401a Plans, 403b Plans, 457 Plans, SEP IRAs, SIMPLE IRAs

College Savings Plans

529 Plans, Coverdell Education Savings Plans, UGMA and UTMA Custodial Accounts

Employee Benefits Plans

Critical Illness, Accident Insurance, Group Life Insurance, Group Disability Insurance.

You may or may not qualify for all or any of the options above. The best way to discover your options is to schedule a free consultation with a specialist today.

What is Life Insurance?

Life insurance isn’t just a policy it’s a commitment to the ones you love. We offer flexible plans tailored to your needs, so you can:

Provide Financial Security: Ensure your loved ones are financially protected if the unexpected happens.

Cover Outstanding Debts: Protect your family from the burden of unpaid debts, like mortgages, loans, and final expenses.

Plan for Education Costs: Leave a legacy that supports your children's dreams and aspirations.

Common Types of Life Insurance

Term Life Insurance

Term life insurance or term assurance is life insurance which provides coverage at a fixed rate of payments for a limited period of time, the relevant term. After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. If the life insured dies during the term, the death benefit will be paid to the beneficiary. Term insurance is the least expensive way to purchase a substantial death benefit on a coverage amount per premium dollar basis over a specific period of time.

Whole Life Insurance

Whole life insurance, or whole of life assurance, is a life insurance policy that remains in force for the insured's whole life and requires (in most cases) premiums to be paid every year into the policy.

Universal Life Insurance

A type of permanent life insurance. Under the terms of the policy, the excess of premium payments above the current cost of insurance is credited to the cash value of the policy. The cash value is credited each month with interest, and the policy is debited each month by a cost of insurance (COI) charge, as well as any other policy charges and fees which are drawn from the cash value, even if no premium payment is made that month. Interest credited to the account is determined by the insurer, but has a contractual minimum rate of 2%. When an earnings rate is pegged to a financial index such as a stock, bond or other interest rate index, the policy is a "Equity Indexed Universal Life" contract.

Protect What Matters Most

Schedule a No obligation Consultation and get your choice of a FREE $300 Hotel Saving Card, or a $200 Restaurant Dining Advantage Card.

The Hotel Savings Card provides wholesale rates at over 1 Million Hotels worldwide and the

Restaurant Dining Advantage Card provides you with discounts at over 55,000 Restaurants around the country!

Enjoy this great offer! Compliments of Pinnacle Financial Group.

Additional Services

Mortgage Protection

Safeguard your home and family with Mortgage Protection Insurance, ensuring peace of mind during life’s uncertainties.

Final Expense

Secure peace of mind with Final Expense Insurance covering end-of-life costs and easing the financial burden on your loved ones.

Will & Trust

Protect your legacy with a Will & Trust. Ensure your wishes are respected and your loved ones are cared for.

Medicare

Navigate your healthcare with confidence through Medicare. Get the coverage you need for a healthier, worry-free future.

Dental

Dental insurance covers check-ups, cleanings, and treatments, helping reduce costs and ensuring your smile stays healthy and protected.

Vision

Vision insurance helps cover eye exams, glasses, and contact lenses, ensuring clear sight and eye health at affordable rates.

Long Term Care

Long-term care offers medical and personal support for chronic illnesses or aging, enhancing independence and quality of life. Services are provided at home, in assisted living, or nursing facilities.

Partnership Opportunity

We offer a platform for....

Independent Insurance Agents and Financial Professionals. Unparalleled Support with a People First Culture, Ownership Equity Appreciation, Strategic Marketing Opportunities, Operational Support, Access to the Industry’s Best Carriers, Proprietary Technology, Competitive Health and Wealth Platform

Dental

Dental insurance covers check-ups, cleanings, and treatments, helping reduce costs and ensuring your smile stays healthy and protected.

Vision

Vision insurance helps cover eye exams, glasses, and contact lenses, ensuring clear sight and eye health at affordable rates.

Long Term Care

Long-term care provides medical and personal support for aging or chronic illnesses, promoting independence and quality of life.

Partnership Opportunity

We offer a platform for supporting financial professionals with equity ownership , top carriers, marketing, operations, proprietary technology, and competitive compensation.

What is an Annuity?

Annuities are contractually-executed, relatively low-risk investment products; the insured (usually, an individual) pays a life insurance company a lump-sum premium at the start of the contract. That money is to be paid back to the insured in fixed, incremental amounts, over some future time period (predetermined by the insured). The insurer invests the premium; the resulting profit/return on investment fund the payments received by the insured, and, compensate the insurer.

Conventional annuity contracts provide a predictable, guaranteed stream of future income (e.g., for retirement) until the death(s) of the beneficiaries(s) named in the contract, or, until a future termination date – whichever occurs first. These financial instruments have been used to accumulate funds and provide significant and sudden increases in personal income (via future, lump-sum withdrawals), all while legally

avoiding the taxes (e.g., income-, capital gains-, estate-) that would otherwise be assessed on them.

Annuities: Guaranteed Income for a Worry-Free Retirement

Annuities are a smart way to transform your savings into a reliable income stream, helping you enjoy the retirement you deserve. With our annuity options, you can:

Generate Lifetime Income

Make the most of your retirement by securing a steady income for life.

Protect Against Market Volatility

Reduce risks and enjoy peace of mind, even in uncertain markets.

Plan with Flexibility

Customize your annuity to fit your retirement needs, from immediate to deferred options.

Compare the FlexVault with traditional programs and decide for yourself:

Traditional 401K, 403B or IRA

You Have Hidden Fees: in fact, you have several categories of fees that are eating away at your retirement savings.

Your Money is NOT Liquid: you cannot access your money whenever you want or need to use it, without penalty charges and taxes owed

Your Money is NOT Protected NOR Guaranteed: no matter how your portfolio is setup, your money is directly exposed to the market and you can absolutely lose a significant chunk of your savings/investments.

Deferred Taxation Could Deplete Your Savings Faster Than You Think: the Trump era Tax Cuts & Jobs Act expires at the end of 2025, and with budget deficits and federal debt at all-time highs, you can bet taxes will go up. Are you willing to gamble losing another large chunk of your nest egg to higher taxes and risk running out of money in retirement?

Flex Vault for the Comparison

Transparent Fees: our fees are competitive, and we clearly show them where applicable so you can make informed decisions.

Your Money is Liquid: you can easily access a certain percentage of your money each year without worrying about paying taxes or penalties if you need it.

Almost No Market Risk, 0% Floor: regardless of how the market performs, you will have the peace of mind knowing your savings will NEVER go below the guaranteed indexed protection.*

Longevity and Legacy Benefits: provides tax-free withdrawals and loans during retirement, can offer more flexibility and after-tax income than a 401(k). Additionally, the tax advantages continue when transferring wealth to heirs, as the death benefit is often received income tax-free, creating a tax-efficient legacy

6 Retirement Risks

Protection Risk

An untimely death or accident can create additional stress and financial pressure on our closest loved ones if we don't plan ahead.

Market Risk

A single 20% or 30% market crash can not only hurt your account balances, but it can cause you to run out of money years sooner.

Income Depletion Risk

Will your nest egg provide enough income to give you the retirement you want, for as long as you live? Most people have no idea.

Tax Risk

CPA and Tax Expert says “Taxes are a larger risk than market crashes.” If you have all your retirement income in qualified plans like IRAs and 401(k)s that require you to pay taxes when you take the money out, you have a huge tax liability.

Healthcare Risk

Statistics show that long term health care costs can be the largest expense in retirement. What have you done to protect your nest egg and your family from being hammered by this expense?

Longevity Risk

Longevity is the great RISK MULTIPLIER. Do you know how long you will live? Hopefully a long prosperous life. Longer life spans multiply the likelihood of each of these risks happening to you.

Schedule a No Obligation Consultation and Enjoy a Complimentary Vacation with No Timeshare Presentations.

You Pay the Resort Taxes & Travel Fees.

Ask Us How You Can Qualify?

After activation you will have 18 months to select travel dates and be responsible for your own transportation, food & beverages, gov taxes & fees and other miscellaneous personal expenses.

This Is Likely The First Question You Might Be Asking About This Bonus Trip.

IS THIS REAL?

THIS SOUNDS TOO GOOD TO BE TRUE..

Our travel partner RedeemVacations.com has given away tens of thousands of these travel vouchers over the years and thousands come back to comment on their experiences, leaving testimonials on 3rd party review websites like Trustpilot, Google, Sitejabber, and even video reviews on YouTube & SoTeLLUs.com. Click below to see these testimonials for yourself.

Here is what our past travelers say about us

Contact Us

Address: 1515 N. University Drive Suite 222 Coral Springs, Florida 33071

Phone: (954) 507-6013

Email: [email protected]

Send Us Message

© 2024 - Pinnacle Financial Group All Rights Reserved